Insurance Innovation & Technology Trends of 2022. Have you Implemented any of these in your strategy Yet?

The insurance industry has been under lasting change spurred from competitive tensions for decades but, last year the industry swirled upside down. The pandemic forced many companies to quickly commit to their customers in new ways and subsidize digital channels to overhaul their customers, innovate their workflows to cater to the new normal scenarios.

Now, the insurance industry is innovating and transforming faster than ever with new challenges and transformation needs. Most insurance companies are looking for new avenues to enhance their customer footprints, revenue streams and above all to streamline their processes and improve ROI.

Technology itself proposes new areas for adoptions, still many enterprises are still reactionary and badly planned. It has mandatorily become important that companies need to understand their customers better than before and view their workflows through a newer lens significantly supported by digital transformation and technology innovations.

To answer all of the above questions that are lingering in our heads, let’s take a look at the technology & innovation trends of 2022 that will have a long-lasting impact on the insurance world.

So what will be the driving factor for 2022? What trends are going to be the talks of the town? Where will everyone be heading into?

Long term Technology Transformations

With everything now coming back to normal, insurers will now start evaluating their technology priorities and many of them will start refining and scaling various digital adaptations, mostly surrounding customer engagement, process automation, and a few of the long-term technology strategies. Above all, the core importance will certainly rely on the modernization of the legacy systems for better integration, data analytics, and workflow automation.

As the world grows more into working from home ecosystems, security and data protection will surely be one of the top priorities for the insurance world making cybersecurity, remote work environments, and risk management that will fetch the larger investments.

AI, Analytics and Cloud to Reimagine Insurance

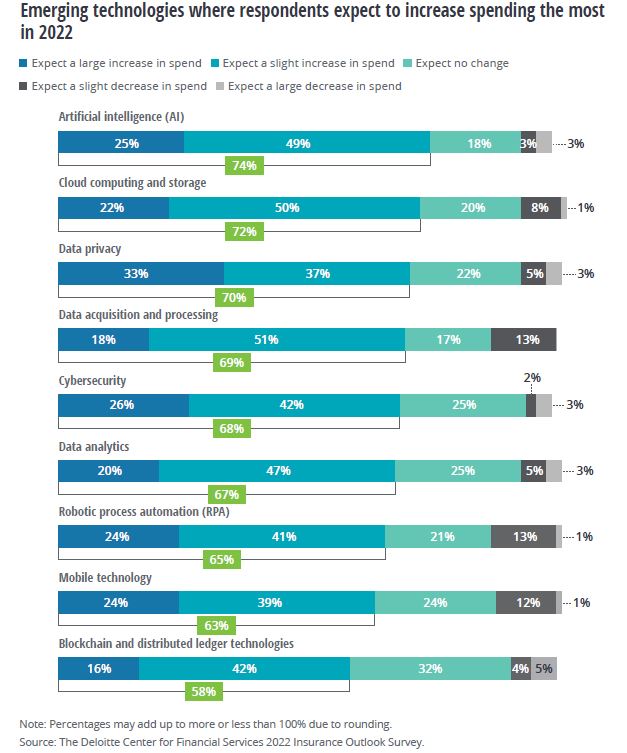

The disruption from COVID-19 changed the timelines for the adoption of AI, analytics, and cloud by significantly accelerating digitization for insurers. Many of the organizations literally had to accommodate remote workforces, digital distributions expansion, and various online channels for data, people, and process interactions overnight. But, now as we are standing on the line of new normal, companies will now show greater willingness to embrace change will put them in a better position to incorporate AI, Analytics, and Cloud solutions into their operations, fetching increased investments. The core technology trends AI & ML, Data Analytics, and Cloud will reshape the insurance industry over the next decade.

These technology evolutions are going to impact all facets of the insurance worlds starting from underwriting, pricing, claims to customer engagement, policy and customer servicing, marketing, and sales.

Above all, the key is to find what your customers actually want!

It’s no rocket science to come to an understanding that customers are the key to every insurance industry. So, it is of utmost importance that you should know what your customers actually want. We often focus exclusively on personal lines when we talk about theories of customer understanding or customer journey in insurance. Wherein the Fact is, individuals, groups, and people working at companies all tend to expect identical things. They want things that are easy and wish for a quick solution to their needs. Maybe it be, advice to purchase, to make changes to their strategy, or complicated lawsuits.

Personalised experience backed up by digital & automated workflows

In insurance, customers always prefer to interact with agencies, dealers, and insurers on the aisle of their choice but not at the expense of losing the ease of interaction. They want to power digital assistance, extremely via mobile devices and personalized. The important expectation is whenever customers start the interactions, they expect whoever responds to them to have the context of their problem, their strategies, and give advice—not just transactional assistance. What customers are looking for nowadays is the best of both worlds – independence of completely digital and computerized journeys and empathy. With technology, it has become easier to provide more emotional and compassionate customer interactions with easy-to-navigate interfaces, mechanisms, and with AI, this can be a more personalized exchange.

Maintain the latest trends

You can keep on top of the latest movements in insurance by following technology conferences led by insurance industry leaders. In 2022, we foresee that many of the biggest trends across the insurance business will be data-driven reactions to the impacts of Covid-19.

2022, like 2021, will be a hard year for many insurers. Hopefully, insurers will make intelligent choices to stay on the path of the digital transformation adopting newer technologies and innovation driving their customer journey, process automation, workflow improvements, and risk mitigations.

How Altains Can be of Help?

Atlains has been at the forefront of these technology trends and has been actively innovating & adopting the latest technologies such as AI, ML, Data Analytics, and Cloud ecosystem in its developments, and deliveries providing our customers an additional edge over their competition with a customer-first approach.

Find out more on how we can help you, reach out to us at info@getaltians.com.